Articles

Update from BOI - OIE: A Summary for Economic Growth

02/04/2014The global economy today looks much healthier when compared with 12 months ago. Then, fears over the 'fiscal cliff' in the United States, the recession in Europe and the rebalancing of China's economy were dampening growth prospects across the world, and globally, business confidence was at its lowest since the financial crisis. Furthermore, growth in developing economies as a whole slowed in 2013, but they still are expected to expand faster than more developed economies in 2014. Still, this improved outlook for the global economy is complicated not only by the fragility of the Eurozone, but also by the reduction of the US Federal Reserve's massive quantitative easing program. Talk of tapering sent many emerging markets into a negative spiral in the middle of 2013. Without a doubt, the global economy is rebalancing and this development will define 2014.

The Office of Industrial Economics, which is under the Ministry of Industry, has compiled its annual report on the Thai economy, offering a good summary of economic growth, sector by sector, in 2013. It also identifies sectoral trends for 2014. What follows is a brief synopsis of certain key sectors of Thai industry, more specifically their condition and outlook.

IRON AND STEEL

The production of primary iron and steel products in 2013 totaled 7,050,041 metric tons (excluding semi-finished iron products, cold-rolled flat sheets, coated steel, and pipe & tubing, to avoid double-counting), an increase of 4.90% compared to the same period last year. This is attributed to the construction industry continuing to expand last year, particularly due to projects from the private sector. For example, condominium construction projects along mass rail routes remained popular. But there was a regression of the global iron market because of the continuous decline of the world economy. Nevertheless, certain manufacturing countries like China, India, and the Republic of Korea increased their production despite declining domestic consumption in their respective countries. As a result, these big manufacturers exported their products to ASEAN countries, thereby affecting Thai manufacturers because of competitive pricing. The import value of primary iron and steel products in 2013 was 342,429 million baht, an increase of 6.76% when compared to 2012. The export value was 31,808 million baht, a decrease of 14.73% compared to the same period last year. The outlook for Thailand's iron demand in 2014 is expected to fluctuate according to the country's macro-economic conditions.

ELECTRICAL APPLIANCES AND ELECTRONICS

The electrical appliance and electronics industry in 2014 is expected to increase slightly by 2-3% compared to last year. The electrical appliance sector is projected to grow 1% as exports to ASEAN and Asian markets improve. However, the domestic market is expected to continue to slow down. The electronics sector is projected to increase 3% stemming from continuously increasing demand from the US market. The production index of the Japanese electronics sector had improved prospects in late 2013, a positive sign for 2014.

The Semiconductor Industry Association reported that the global distribution of semiconductors for 2014 is projected to reach US$316 billion, an increase of 4.1% compared to 2013. All major markets experienced growth, including the US, Japan, Asia-Pacific, and the European Union, increasing 6.5%, 3.8%, 3.7% and 1.8%, respectively.

AUTOMOTIVE

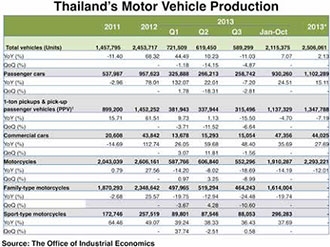

During the first 10 months of 2013 (Jan.-Oct.) the automotive industry slowed in terms of production and distribution. Imports dropped but exports slightly increased. The full year 2013 saw the same trends. Data from the production plans of automotive manufacturers estimated that in 2014, automotive output would reach approximately 2,600,000 units, with domestic distribution accounting for approximately 50-55% and exports accounting for roughly 45-50%.

During the first 10 months of 2013 (Jan.-Oct.), production, distribution and imports of motorcycles slowed compared to the same period in 2012. Exports increased. The motorcycle industry in 2014 is expected to remain unchanged compared to 2013. Data from the production plans of motorcycle manufacturers estimates that in 2014, motorcycle output will reach 2,415,000 units, with domestic distribution accounting for just about 85-90% and exports accounting for 10-15%.

PETROCHEMICALS

Thailand's petrochemical industry in 2013 was expected to expand slightly when compared to 2012. Major factors include the economic condition of Thailand and its export markets, including China and Japan, which enjoyed increased growth. However, the instability of the EU and US economies remain critical factors to be monitored. In the short term, manufacturers in the petrochemical industry adjusted their production plans corresponding to local and global economic conditions. In the long run, to minimize risks, markets in newly developing countries should be explored, especially newly emerging economies.

The petrochemical industry in 2014 is expected to grow according to the expansion of intermediate industries and downstream industries, i.e. the plastics, electrical appliances and electronics, and automotive industries. If the Thai government's stimulus programs in 2013 had been realized, they would have resulted in a large expansion of many industries in the country. However, economic problems and instability in both the EU and the US, as well as local political instability will be critical factors that must be watched closely.

CEMENT

The cement industry should continue to expand in 2014 due to continuous growth in domestic cement consumption. Although investments in infrastructure systems by the public sector may not increase cement demand by much, construction projects of mass railway routes should enable the private sector to expand its investments in real estate projects along those routes, especially high-rise residential buildings or condominiums that require large amounts of cement. Potentially higher domestic consumption of cement would result in a lower export volume for cement manufacturers in 2014. Certain cement manufacturers expanded their domestic production capacity to accommodate increased domestic demand, which was expected to grow 10% in 2014, while its major export markets remained steady, especially Myanmar.

PHARMACEUTICALS

Pharmaceutical production and domestic distribution in 2014 is expected to increase as strict government disbursement controls partially increased domestic production, which replaced costly medicinal imports that can be manufactured locally.

Pharmaceutical exports in 2014 are expected to drop because producers need to adjust their manufacturing processes to comply with the EU GMP (Good Manufacturing Practice) or PIC/S (Pharmaceutical Inspection Co-operation Scheme) requirements of major trading partners. Pharmaceutical imports in 2014 are expected to decrease slightly because major customers, which are public hospitals, postponed the disbursement of imported and expensive medications in order to use more locally produced medicines.

RUBBER AND RUBBER PRODUCTS

The rubber and rubber products industry is likely to grow in 2014, particularly the vehicle tires industry as the domestic automotive industry continues to expand. For rubber cleaning gloves/inspection gloves, although major markets like the European Union declined, ASEAN markets are likely to improve, compensating for lower exports to traditional markets. Countries whose automotive industries enjoyed continuous growth, like India, Vietnam and Brazil, still have high demand for rubber. This is a supporting factor that should buffer the industry from negative impacts.

Rubber prices in 2014 are difficult to predict. Major negative factors include trading prices in futures exchanges and reduced oil prices, as well as the ongoing economic crises in EU and US. This caused rubber consumption to remain low and continue to drop.

FOOD

During 2013, the food industry remained largely at the same level as in 2012, benefiting from better domestic demand as a result of an increase in wages and salaries, which provided consumers with more purchasing power. Although prices rose, most production stayed at the same level as 2012, except for sugar output. Analyzing foreign factors, production and exports for many items were affected by the sluggish European Union economy, which is a major marketplace for Thai foods.

Production and exports for the food industry during 2014 are expected to escalate in accordance to the recovery of the world economy. Major importing countries, like China and Japan, have seen their economies recover from the global debt crisis, though the same cannot be said of the EU. The US must be monitored closely with regards to ongoing political negotiations between the White House and Congress, and whether a higher debt ceiling will be approved. Domestically, some benefits may be gained from expenditures on large-scale projects by the public sector. Hence, domestic spending conditions should not slow down too much. But the impact of the current political impasse in Thailand must be taken into consideration if the demonstrations are prolonged. Food categories expected to expand production include: Livestock products, particularly processed chicken and fresh chicken; Fisheries; Vegetables and Fruits; and Sugar products.

Source: Thailand Investor Review, March 2014, Volume 24, No. 3

http://www.boi.go.th/tir/issue_content.php?issueid=109;page=0